- Safety & Recalls

- Regulatory Updates

- Drug Coverage

- COPD

- Cardiovascular

- Obstetrics-Gynecology & Women's Health

- Ophthalmology

- Clinical Pharmacology

- Pediatrics

- Urology

- Pharmacy

- Idiopathic Pulmonary Fibrosis

- Diabetes and Endocrinology

- Allergy, Immunology, and ENT

- Musculoskeletal/Rheumatology

- Respiratory

- Psychiatry and Behavioral Health

- Dermatology

- Oncology

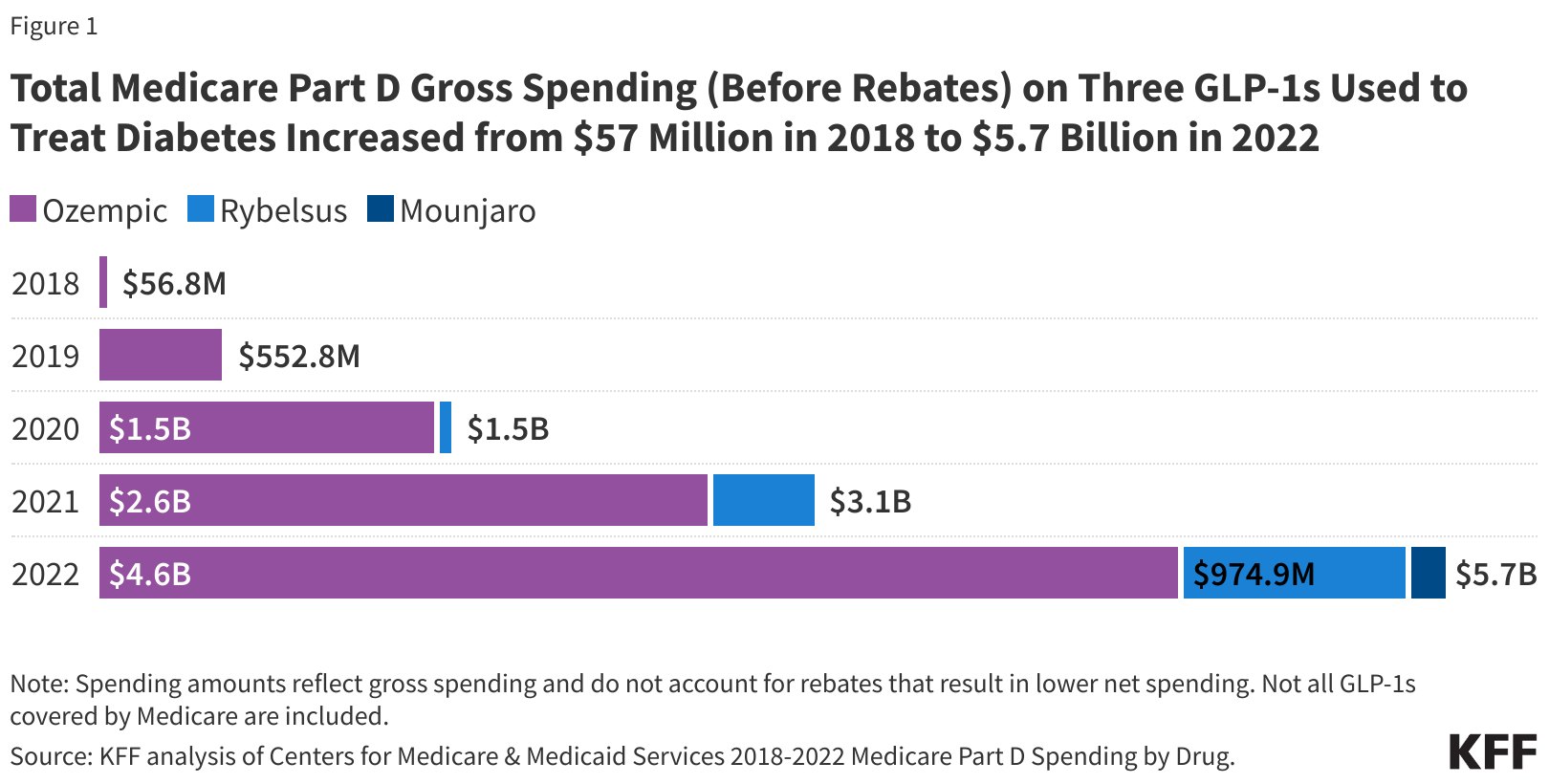

Medicare’s Spending on Ozempic and Other GLP-1s Rises Steeply

Ozempic and Rybelsus could become a target for Medicare price negotiation because of high spending and additional approved uses of the GLP-1 therapies.

In 2022, gross total Medicare spending for GLP-1 therapies used to treat diabetes reached $57 billion, up from $57 million in 2018, according to a new analysis from KFF. KFF looked at Medicare Part D spending before rebates of Ozempic (semaglutide), Rybelsus (semaglutide), and Mounjaro (tirzepatide).

Increased attention has been on the GLP-1 class of medications after semaglutide was approved as Wegovy and tirzepatide as Zepbound to treat obesity.

Medicare Part D is unable to cover weight loss medications because of the way the law was written. But Medicare provides coverage for the GLP-1 therapies that treat patients with diabetes or other medically accepted indications.

Related: Medicaid, Medicare Part D to Provide Coverage of Wegovy, But Not for Weight Loss

This is why Medicare is now able to provide coverage for Wegovy for some patients. Wegovy is a 2.4 mg version of semaglutide approved for weight loss. It was recently also approved for an additional indication: to reduce the risk of cardiovascular death, heart attack and stroke in overweight patients with heart disease. The approval is based on the SELECT cardiovascular outcomes trial, which demonstrated that Wegovy statistically significantly reduced the risk of major adverse cardiovascular events by 20% when added to standard of care.

But despite the prohibition against coverage for weight loss, Medicare spending on GLP-1 therapies has increased tremendously. For example, Ozempic in 2022 was the sixth highest drug in terms of Medicare by total gross spending at $4.6 billion, up from $2.6 billion in 2021. (See Figure below)

KFF officials speculate that that the diabetes drugs Ozempic and Rybelsus could be targeted for possible drug price negotiation in 2025, especially if these therapies are approved for additional uses or legislation allows for Medicare coverage for weight loss. Ozempic has a list price of $935.77 for one pen and Rybelsus has a list price of $935.77 for 30 tablets.

New uses could be on the horizon for Ozempic. Earlier this month, Novo Nordisk — the manufacturer of Ozempic, Rybelsus and Wegovy — announced that Ozempic 1.0 mg reduced kidney disease progression, major adverse cardiovascular events and death by 24%, according to topline results from the FLOW trial. The trial was stopped early on the recommendation from an independent data monitoring committee because an interim analysis found the study met the criteria for efficacy.

Additionally, at least one bill has been introduced in the Senate to expand coverage in Medicare for obesity treatments. Sponsored by Sen. Thomas Carper (Dem.-Del.), the bipartisan bill would expand coverage for medications and provide for regular screenings. It has been referred to the Committee on Finance.

“By tackling obesity head on, we can better prevent numerous additional diseases such as heart disease and diabetes, helping lengthen Americans’ health spans while also saving taxpayer and Medicare dollars over the long run,” cosponsor Brad Wenstrup (R-Ohio) said in a news release when the bill was introduced in September 2023.

Kff said in its brief that competition among GLP-1 drugs could result in lower prices and higher rebates. “But the combination of intense demand, new uses, and high prices for these treatments is likely to place tremendous pressure on Medicare spending, Part D plan costs, and premiums for Part D coverage,” KFF officials said.

Source: KFF

Payers Recognize the Benefits, but Still See Weight Loss Drugs through a Cost Lens

April 12th 2024Jeffrey Casberg, M.S., R.Ph., a senior vice president of clinical pharmacy at IPD Analytics LLC, a drug intelligence firm that advises payers and pharmaceutical companies, talks about how payers are thinking about weight-loss drugs.

Humira Biosimilars Have a Slow Uptake, Finds Samsung Bioepis Report

April 8th 2024Caps on Medicare Part D cost sharing as a result of the Inflation Reduction Act, could reduce members’ financial incentive for switching to a biosimilar, suggests the newest Samsung Bioepis Quarterly Biosimilar Market Report.